How Does PayPal Work?

If you’re currently a business owner or are thinking about becoming one, you’ve no doubt heard of PayPal. You may have even used it a few times as a consumer. But now that you’re in business mode, you may be curious about what the popular platform has to offer as a payment system.

The first chapter of this guide covers what PayPal is, but in case you’re not familiar with payment gateways in general, here are their typical capabilities and attributes:

- They enable online and in-person payments for goods and services.

- They provide a way for individuals to send or request money.

- They provide varied levels of digital security and payment protections.

- They charge a variable or fixed fee for their services, or a mix of the two.

We have plenty of guidance on PayPal specifically in the rest of this guide. It’s also chock-full of insights from business owners who have used PayPal in one form or another for years.

Chapter synopsis

This guide consists of several chapters, which you can easily navigate to at any time:

- What is PayPal? Learn about the basics of PayPal.

- PayPal business solutions. Get an in-depth look at the business services PayPal offers.

- PayPal personal solutions. Get a buyer’s look at payments to better understand their perspective.

- Benefits and drawbacks of PayPal. Discover what you’re really getting with PayPal — both the good and the bad.

- How safe is PayPal? Security is always a concern when it comes to money. See what protections PayPal has in place for buyers and sellers.

- PayPal software, apps, and integrations. Learn about the technology PayPal offers to enhance the buyer and seller experiences.

- The PayPal + JotForm integration makes accepting payments easy. See how PayPal integrates with JotForm to make accepting payments a snap.

Remember to bookmark this guide for later reference. Your journey as a business owner is a long one.

You can also download the PDF version of this guide for free!

What is PayPal?

PayPal is a well-known digital payments platform used by businesses and consumers alike to conduct financial transactions around the world — via the web, mobile apps, or in person. With PayPal, you can pay bills, send and receive money, accept payments, and more.

Here are a few interesting facts about the service, as noted on its website:

- More than 267 million active account holders

- Available in more than 200 markets worldwide

- Supports the receipt of 100+ currencies, fund withdrawals in 50+ currencies, and balance holdings in 25+ currencies

- Founded in December 1998

- Headquartered in San Jose, California

- Owns other brands, including Braintree, Venmo, and Xoom

- Provides financial support ($3.7M in 2017) to nonprofits and charities annually

- Has its own dedicated typeface, called PayPal Sans

Who uses PayPal?

Compared to a traditional merchant account you’d get through a bank or other financial institution, PayPal has a lower barrier of entry. That means just about anyone can create a PayPal account and start using it — sometimes in the same day.

The result? All types of businesses, independent ventures, and everyday consumers use PayPal. Let’s look at a few examples:

- An entrepreneurial teen selling custom-made T-shirts. All someone needs to sell something is a product (or service) and access to a laptop or phone. Most teens have the latter — so all they need to do is make their shirts; download the PayPal app; and convince their friends, classmates, and family to swipe their cards or send money.

- A large group of friends at dinner. Sometimes it’s easier for one person to pay and then have everyone else pay them back afterward. Instead of trying to collect cash from each person, PayPal lets people use credit cards or funds from their bank accounts to send the money directly to an account.

- A corporate worker with a side hustle. Many traditional employees often start their entrepreneurial journey by moonlighting — performing work that isn’t supplied by their main job. Decades ago this meant having a second job somewhere like a retail store, working in the evening and/or on the weekend. Today, this could be anything from selling products online to selling services as a freelancer or consultant. In any case, PayPal gives these would-be entrepreneurs the ability to accept money for whatever they’re selling.

- A Fortune 500 company selling…whatever they sell. PayPal isn’t just for small businesses or person-to-person transactions. While large corporations may use the platform for different reasons (such as for customer convenience), they are no strangers to PayPal either. For example, Home Depot lets customers use PayPal online and in store.

Why use PayPal?

It instills trust with customers

Customers are less likely to trust what they haven’t seen, used, or interacted with before. As a small business owner, you’ll struggle with this for longer than you’d like.

Thankfully, PayPal is a well-known, trusted brand. “There’s a lot of value in the PayPal brand, and it’s primarily in the trust it communicates to your potential customers. While they may not know your business, they know PayPal. The result is reduced friction in the payment experience and ultimately more sales,” notes Peter White, founder of Tenancy Stream.

It’s convenient for customers

We mentioned that PayPal has a lot of active users (more than 267 million). That’s a lot of people who use the service and, more importantly, expect to keep using it wherever they shop. They already have their information — bank accounts, credit cards, etc. — set up on their account, which saves them time while shopping.

It’s when that expectation is not met that customers get annoyed or even upset. That’s the friction in their experience that White noted. Some may choose to use another of the payment options you’ve provided to make their purchase, but it’s much more convenient for them to just use PayPal — and likely more lucrative for you to give them what they’re looking for.

It lets you quickly test out business ideas

Since setting up a PayPal account is quick and simple, you can start selling a product or service today. While the product or service you’re selling might not catch on, accepting payment won’t be a problem. If you don’t get any sales or don’t see the profit margin you were expecting, you can scrap the idea and move on to another one.

It’s widely accepted

Who accepts PayPal? While PayPal is a largely digital solution and is accepted by an untold number of online businesses globally, it’s also accepted at more than 18,000 stores in the U.S. Big names like Home Depot, Office Depot, and Foot Locker all accept the service in store and online.

Speaking of businesses, you’re probably curious about what the PayPal experience is like specifically for business owners. We explore that in the next chapter.

PayPal business solutions

OK, so PayPal is popular, but just how popular? Well, more than 19 million merchants — from retailers to restaurants to e-commerce stores — use PayPal.

While every business owner has their own reasons for using the platform, John Frigo, who used to run an e-commerce business for collectibles, says his primary reason was because it helped him keep things organized.

He previously used a WordPress e-commerce store and admits the backend was “all over the place.” However, using several PayPal merchant services together helped him form a recordkeeping system for tracking orders, generating sales reports, etc.

Frigo also notes that PayPal has a lot of flexibility. “You can easily set PayPal up on your website, invoice customers, create digital buttons for quick payment, and accept payment in person, such as at a trade show or street fair. It works for pretty much any situation.”

The platform isn’t without its downfalls, though. Frigo says that buyers can sometimes take advantage of sellers by “working the system.” (We’ll detail more drawbacks and advantages of a PayPal business account in a later chapter.)

Explore your PayPal merchant tools

Here are some of the many PayPal merchant services that help you get the most out of your PayPal Business account:

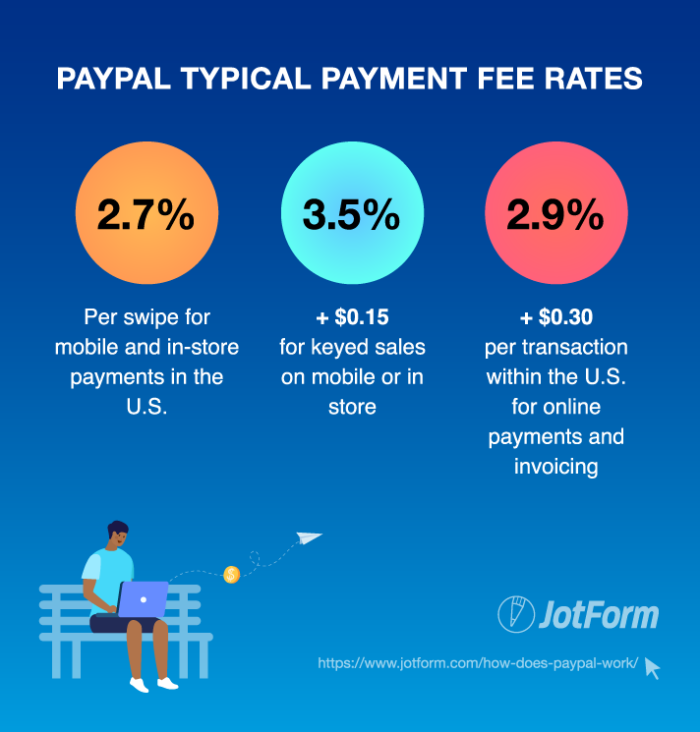

- PayPal payment options. PayPal offers an array of payment options, including credit cards, debit cards, Venmo, PayPal, and PayPal Credit — an option that lets customers pay over time (with credit approval). You can accept payments online, in person, and via invoice. Fees vary and may change, but here are the typical rates:

- 2.7 percent per swipe for mobile and in-store payments in the U.S.

- 3.5 percent + $0.15 for keyed sales on mobile or in store

- 2.9 percent + $0.30 per transaction within the U.S. for online payments and invoicing

- PayPal Business app. The PayPal Business app is available for both iOS and Android. You can download it on the App Store and Google Play for your mobile phone or tablet. It enables you to view your account activity, send invoices, transfer funds, and issue refunds whenever you want. You can also view customers’ transaction history, import contacts, and get in touch directly from your device.

- PayPal business debit card. You can use your PayPal balance anywhere Mastercard is accepted with the PayPal Business Debit Mastercard. The standard cash back rate is 1 percent on eligible purchases, and you can use it at ATMs to get cash.

- PayPal shipping. PayPal offers a fee-free shipping service that even lets you get discounts on USPS and UPS shipping labels. You can purchase and print shipping labels (single or in batches), and track packages through your PayPal account. The service automatically saves your tracking numbers for PayPal Seller Protection.

- PayPal invoicing. Like shipping, PayPal’s invoicing service is also fee free. Quickly create and send prebuilt or customized invoices to customers via email or a shared link. The service accepts partial payments and even tipping. You can also view billing history, track payments, and send reminders.

Discover this hidden gem among PayPal merchant options

Starting or growing your business can be costly, especially in the beginning. Your options for funding are often limited. PayPal offers business account holders two loan options.

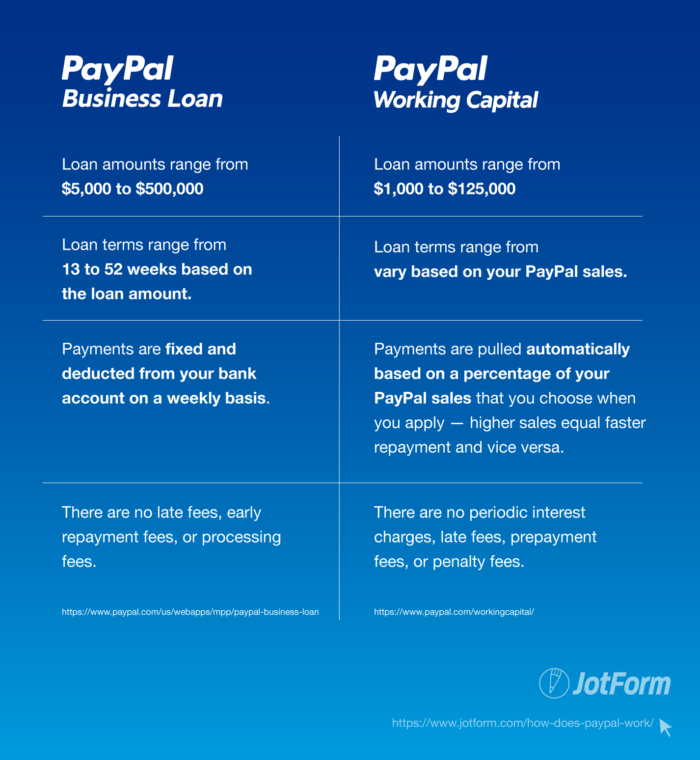

PayPal Business Loan

PayPal notes that this type of loan is best for businesses that have been operating for at least nine months and that have at least $42,000 in annual revenue. You can check your eligibility in minutes online or over the phone. (A credit check is required.) If your application is approved, you can receive funds as quickly as the next business day.

Here are a few facts about the PayPal Business Loan:

- Loan amounts range from $5,000 to $500,000.

- Loan terms range from 13 to 52 weeks based on the loan amount.

- Payments are fixed and deducted from your bank account on a weekly basis.

- There are no late fees, early repayment fees, or processing fees.

PayPal Working Capital

Alternatively, this loan requires no credit check. However, you must be an existing PayPal customer who has had a PayPal Business account for at least 90 days and processed $15,000+ with PayPal within any time period less than or equal to 12 months. Your loan is based on your PayPal sales, and it can be funded in minutes once approved.

Here are a few facts about PayPal Working Capital:

- Loan amounts range from $1,000 to $125,000. The maximum amount can be up to 35 percent of your annual PayPal sales, and no more than $125,000 for your first loan.

- Loan terms vary based on your PayPal sales.

- Payments are pulled automatically based on a percentage of your PayPal sales that you choose when you apply — higher sales equal faster repayment and vice versa. However, you must repay a minimum of 5 percent or 10 percent every 90 days to keep your loan in good standing. You can also make payments manually.

- There are no periodic interest charges, late fees, prepayment fees, or penalty fees.

Boost your business with PayPal partners

Starting your PayPal Business account is just the beginning. While PayPal merchant tools provide a great foundation, PayPal also partners with a number of third parties to help you grow and run your business. Here’s what they help you do.

Build your online store

If you’re interested in e-commerce, PayPal partners with website and online store builders like Wix, Squarespace, Shopify, and BigCommerce.

Wix and Squarespace work well if you’re in the early stages of your business, as they offer simple design tools to get you up and running quickly. Shopify gives businesses of all sizes a broad selection of options, including letting you buy an existing online store. As the name implies, BigCommerce powers big brands like Ben & Jerry’s — offering enterprise functionality and a robust set of analytical tools.

Each partner offers their own version of a discount or special offer for PayPal users, which makes getting started that much easier (and cheaper).

Upgrade your existing online store

Partners like Magento enable you to further develop your online store. You can integrate multiple shopping experiences — eBay, Amazon, your web store, and more — and manage all of your inventory and sales through one system.

Similar to Magento, Miva is another PayPal partner that gives you the tools to boost your online store with capabilities such as marketing tools, social integrations, and automated reordering.

Accept in-person payments in your store

PayPal offers its native PayPal Here solution for accepting payments in your store, but its point-of-sale (POS) partners offer more tailored capabilities. For example, Vend is a leading POS brand focused on inventory management and customer loyalty for retailers. Alternatively, Lavu helps thousands of restaurants and other quick-serve and hospitality businesses take orders and reduce wait times.

Manage your finances with invoicing and accounting tools

Partners like Intuit QuickBooks let you easily import your PayPal transactions, then edit, categorize, and match transactions to keep your books accurate and up to date. Xero is an online accounting software that helps small businesses (and their advisors) simplify bank reconciliations, billing, payroll, and more. Invoice2go is a bit more niche, focusing on invoicing and estimates.

As a business owner, it’s important to always understand your customer’s perspective — which is why we walk through PayPal’s personal solutions in the next chapter.

PayPal personal solutions

Your current and potential customers have a number of options available for paying you. We explore several of these below.

PayPal eChecks and how they work

Here’s how PayPal defines an eCheck:

An eCheck is an electronic payment funded by the buyer’s bank account. An eCheck must clear the bank before it’s credited to the recipient. It usually takes 3 to 6 business days for an eCheck to clear and the money to appear in the recipient’s PayPal account.

Basically, it’s like writing a physical check from your bank, but you’re sending it digitally. Of course, most people don’t use physical checks anymore, but an eCheck is an option if you don’t have a credit card or just prefer to pay directly from your bank account.

Note that you must have enough funds in your bank account to cover the eCheck amount you’re requesting. If you don’t, the bank will decline your request, and PayPal will follow up with a second request. In addition, you cannot use an eCheck if the Instant Transfer option is available.

PayPal instant payment

This payment option is a bit different than an eCheck. Here’s how PayPal defines an Instant Transfer:

An Instant Transfer is a way to send money or make a payment from your bank account instantly using PayPal. The seller is credited immediately while our request for the money from your bank is processing.

To use an Instant Transfer, you’ll need

- A confirmed U.S. bank account with enough funds to cover the full payment amount

- An unexpired backup funding source like a credit or debit card in case your payment request is declined (you can change this anytime before requesting an Instant Transfer)

PayPal eChecks vs instant payment

To clearly distinguish between PayPal eChecks and Instant Transfers, we created this handy reference table that compares the two payment options.

| Item | eCheck | Instant Transfer |

| Time for payment to clear | 3–6 business days | Instantly |

| Need full amount of requested payment in bank account to initiate? | Yes | Yes |

| Backup payment source (credit or debit card) required? | No | Yes |

| If payment is declined the first time | PayPal submits a second payment request within 3 business days | PayPal submits a second payment request within 3 business days |

| If payment is declined the second time | Purchase does not go through | PayPal charges your backup payment source |

| Time for refund to clear | 3–6 business days | Instantly if the payment shows as completed between the bank and PayPal. Otherwise, 2–5 business days after the payment was made |

Frigo shares his thoughts on the PayPal eCheck vs instant payment debate: “In my opinion, there’s really no reason to use an eCheck. It takes entirely too long — both in sending the payment and getting it back if the seller cancels or refunds it. Beyond that, I’ve seen and heard of cases where an eCheck was reversed by the bank months after it cleared, and the seller lost money because of it. When you consider these important factors, Instant Transfer is just the better option for both the buyer and the seller.”

PayPal credit card services

PayPal has a collection of credit, debit, and prepaid cards in partnership with Mastercard. It also offers a digital credit line. Exact terms for each may change over time, so we cover just the basics below.

Credit cards and digital credit line

- PayPal Cashback Mastercard. A 2 percent cash back card with no purchase exceptions and no annual fee.

- PayPal Extras Mastercard. A variable point-earning card that allows redemption for gift cards, travel vouchers, or cash back to your PayPal balance. No annual fee for new accounts.

- PayPal Credit. This digital, reusable credit line lets U.S. PayPal account holders shop online anywhere PayPal is accepted. It requires no card and has no annual fee.

Debit and prepaid cards

- PayPal Cash Mastercard. This debit card gives you access to your PayPal Cash Plus account, whether swiped at a store, keyed in online, or used at an ATM.

- PayPal Prepaid Mastercard. This reloadable debit card acts similarly to the Cash card, only it’s prepaid. You can load funds onto the card via the no-cost direct deposit service, via transfers from your PayPal account, or via a Netspend Reload Network location.

You can read up on PayPal’s credit cards, prepaid cards, debit cards, and more.

We’ve covered solutions available for both sellers and buyers, but what exactly are the drawbacks and advantages of PayPal?

Benefits and drawbacks of PayPal

Beyond the power of its well-known brand, PayPal has a number of business benefits. For example, the PayPal Business account offers many tools and merchant services that can help develop and grow your business. However, PayPal isn’t perfect. Below, we explore both the benefits and drawbacks of PayPal.

Where PayPal wins

Advantages of a PayPal Business account

- You can offer customers multiple payment processing methods. With the platform’s business account, you can process payments from PayPal, Venmo, PayPal Credit, and debit and credit cards — both online and in person.

- You can take advantage of available shipping discounts. PayPal offers a fee-free shipping service. In addition, it also provides discounts on USPS and UPS shipping labels.

- You can get the business debit card. With the PayPal Business Debit Mastercard, you can use your PayPal balance anywhere Mastercard is accepted. Much like a bank debit card, you can make purchases and even get cash from ATMs.

- You gain access to business loans. PayPal Business account holders have the opportunity to apply for one of PayPal’s two business loans, which can help give your business the cash flow it needs to grow. (We explored those loans in detail in the chapter about PayPal’s personal solutions.)

- You can link with PayPal partners. Numerous third parties like Wix and Intuit QuickBooks partner with PayPal to offer your business a helping hand. Through these partners, you can build or upgrade an online store, manage your finances, and more.

Benefits of PayPal Credit

- You can buy now and pay later. As its name implies, PayPal Credit is a revolving credit line that gives you immediate purchasing power without having to pay in full immediately.

- You can avoid interest. PayPal offers promotional financing with no interest as long as purchases of $99 or more are paid in full within six months.

- You can send money. Don’t have enough available funds to pay a friend? You can send them money from your PayPal Credit account for PayPal’s standard fee of 2.9 percent + $0.30 per transaction. Note that any special promotional financing offers don’t apply to these types of transactions.

- You don’t have to pay an annual fee. There’s no fee for maintaining access to your credit line, unlike many credit cards.

Advantages of the PayPal brand

“Buyers know and trust PayPal. They like how easy and convenient it is to use. That’s great for any seller, but especially those just starting out. People don’t know you or your business, and seeing the PayPal brand instantly instills a sense of trust. Greater trust equates to higher conversion. That in itself is one of the greatest advantages of PayPal,” explains Frigo.

Where PayPal falls short

Inadequate seller protection

When it comes to transaction disputes, it’s well known in the seller community that PayPal typically favors buyers, putting the onus on sellers to “prove” their case.

Frigo notes that some buyers know how to “work the system,” taking advantage of PayPal’s protections to get free stuff from sellers. “This is especially true with digital or intangible products where you’re not physically shipping an item. You need a paper trail, as PayPal asks for things like a tracking number that shows the item was delivered to the address the buyer entered. Without something like this, the buyer may automatically get their money back, meaning they got a free product. It’s a huge vulnerability in the PayPal ecosystem,” he cautions.

Limited development customization

While PayPal does offer a sizable number of integrations that cover common business scenarios, the integrations are optimized for only those scenarios. That means any instances outside of these common business cases are not fully covered.

Further, White notes that some PayPal integrations and APIs can be “complex, clunky, or outdated,” not using more modern development approaches like restful API.

“The result is less flexibility, meaning you’ll have to figure out workarounds. For example, it’s difficult to integrate usage-based pricing through PayPal. Whereas with a processor like Stripe, developers in the community have already created solutions for that business case that you can use as is or tweak a bit to your liking,” he adds.

Limited room for business growth

There’s an old saying—don’t put all your eggs in one basket. Using PayPal as your only payment processor could be limiting.

Frigo explains why: “PayPal is a great option for businesses just starting out. It often provides the trust needed to convince people to buy from you. But if anything goes wrong with PayPal, you’re stuck. So as you grow your business, assess the market and see what other payment processing options are available and could work for you. One solution may offer lower fees. Another one may be more customizable and provide a payment flow that suits you and your customers better. In short, keep your options open.”

How PayPal stacks up against competitors

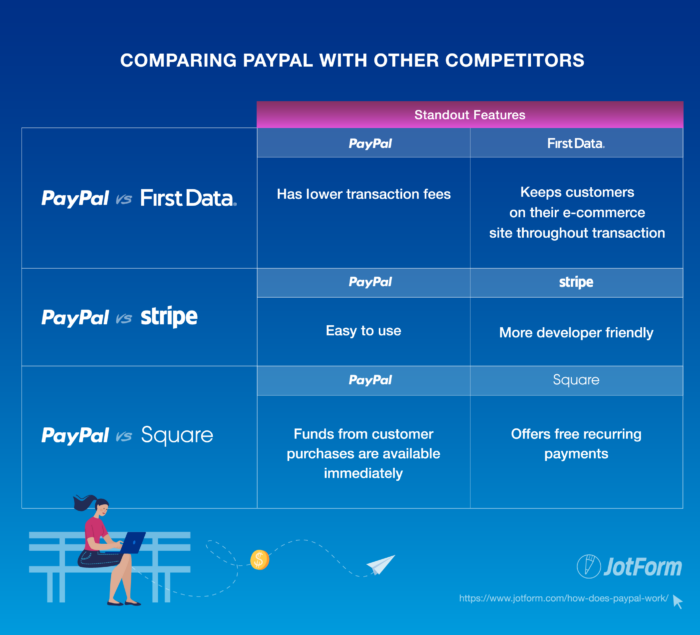

PayPal vs First Data

Compared to First Data, a more traditional payment processor, PayPal has a lower barrier of entry for merchants. It has fewer documentation requirements and require less setup time. Another big win for PayPal is its fees. PayPal offers lower processing fees, doesn’t charge monthly account and maintenance fees, and doesn’t impose multiyear contracts that bind your business with early termination fees.

On the other hand, First Data is the larger player, processing 45 percent of all credit and debit card transactions in the U.S. — through direct transactions and third parties. And unlike PayPal, First Data keeps customers on your e-commerce site throughout their transaction. (PayPal sometimes navigates your customers away from your site to pay with their PayPal accounts.) For larger businesses with a high number of sales, First Data offers discounted pricing and a robust tool set, such as in-depth reporting capabilities.

PayPal vs Stripe

PayPal and Stripe are actually quite similar in many ways. Both charge the same processing fee. Both offer a large knowledge base of frequently asked questions and how-to content. And neither requires a contract or charges an early termination fee.

The largest distinction between the platforms revolves around their integrations. As noted earlier, Stripe has a more developer-friendly platform. It’s highly customizable, so if you’re looking to develop a payment flow for maximum conversion, Stripe is your platform. If you’re looking for pure ease of use, PayPal is probably the better option.

PayPal vs Square

PayPal’s card processing fee for point-of-sale and mobile transactions is 0.05 percent less than that of popular payment processor Square. In addition, PayPal is geared toward e-commerce businesses, easily integrating with all popular e-commerce platforms.

PayPal wins over Square when it comes to funds availability. While funds from customer purchases on PayPal can be available immediately, funds from Square take one to two business days to transfer and be usable.

However, if you’re looking to set up a recurring payment option for your customers, Square offers this service for free, while PayPal charges $40 per month. Square also has advanced business management tools for brick-and-mortar businesses. For example, it offers a robust point-of-sale software, along with inventory, sales, employee, and customer management tools.

Next, onto one of the most common questions people have about this payment processing platform: Is PayPal safe?

How safe is PayPal?

When online shopping first started, people were highly skeptical and often concerned about the safety of their information. Despite how popular and commonplace it’s become, that concern is still a reality, though it’s not nearly as prevalent as it once was. It’s perfectly understandable to wonder about the safety of a service like PayPal — for both buyers and sellers. Let’s take a look at the varying perspectives on safety.

How secure is PayPal for buyers?

PayPal buyer protection

Sean Dawes, cofounder of Modded Euros, summarizes PayPal buyer protection this way: “By offering fraud protection and digital encryption, and masking financial information from sellers, PayPal ensures buyers are able to buy with confidence online. If there’s ever an issue with a purchase, buyers can file disputes. PayPal then acts as a mediator between the buyer and seller to resolve any order-related discrepancies, such as a lost or damaged package, or a package shipped to the wrong address.”

Purchase resolution process

PayPal’s resolution process is meant to give buyers confidence that, if something goes wrong with their purchase experience, there is an established approach to remedy the problem. In most cases, this means getting a refund on the purchase price and even the shipping costs.

Buyers have about six months (180 days, to be exact) from the date the payment was made to start the resolution process. Here’s how it works:

- Buyer opens dispute. The buyer opens a dispute in their PayPal account and communicates directly with the seller to seek a remedy.

- Buyer escalates to claim. If the seller doesn’t respond or doesn’t provide a remedy the buyer is satisfied with, the buyer can escalate the dispute to a claim — as long as they do so within 20 days of opening the dispute.

- PayPal investigates and resolves. Once the issue has been identified as a claim, PayPal begins investigating. PayPal may request supporting documentation — e.g., proof of delivery, receipts, police reports — from both the buyer and the seller.

Frigo cautions that the last step of the process is where sellers can get taken advantage of: “If you read the terms of service closely, you can see where there’s room for buyers to work the system. The terms tell you that if you can’t give PayPal sufficient evidence in a ‘timely manner,’ the buyer can win the dispute—even if their purchase wasn’t eligible for PayPal buyer protection! You really have to be careful as a seller. It can be a hassle, but always keep your receipts and any documentation related to buyers’ purchases.”

To be fair, PayPal notes that, should the seller provide the needed evidence, the seller could win the dispute. This is true even if the buyer claims to have not received the item. In any case, while reality may see buyers winning disputes more often than sellers, PayPal’s terms appear to allow for fairness in the resolution process.

Learn more about PayPal buyer protection.

Safety advantages of PayPal vs credit card

When buyers make a purchase online, they have a choice to make. Some may choose to use their PayPal account because it’s convenient, but others may prefer using their credit card because they want to collect points or because they don’t have their credit card tied to their PayPal account.

For the latter type of buyer, having only PayPal as an option may turn them off. In any case, PayPal has several safety advantages over credit cards that may convince these would-be buyers to use PayPal:

- As we described in detail in the last section, PayPal’s buyer protection program offers a resolution process that can result in buyers getting a full refund. This is an important safety net should something go wrong during a transaction.

- PayPal also has a security key service that acts as a secondary authentication factor. Whenever you try to log into your PayPal account, the service sends you a text message with a temporary security code. You enter this code, along with your password, to gain access.

- If your credit card information is stolen, it can be used to make purchases both online and offline. However, if your PayPal account is compromised and your credit card is connected to your account, the card can only be used to make purchases online.

- On the technical side, PayPal employs transport layer security (TLS) connections whenever you log in. According to its security page, “Strong TLS configurations are the current industry standard for trusted communication channels and allow your information to transmit across the internet in a secure manner.”

For tips on keeping your accounts safe, check out this article.

PayPal app security

Like the transactions made from your computer or mobile browser, transactions made through the PayPal app are also protected with the same security policies. PayPal does employ some additional security measures for its iOS and Android apps:

- Your login sessions on the app time out after 15 minutes, meaning you have to log back in after the time is up.

- Key pinning is implemented when you access the app, ensuring that your mobile device connects to a “true PayPal server.” This prevents PayPal impostors from hijacking the connection.

How secure is PayPal for sellers?

PayPal seller protection

Much like PayPal buyer protection, PayPal seller protection provides sellers with fraud prevention measures and financial protections. Dawes adds this about PayPal seller protection: “One of the most important things to pay attention to with orders as a seller is the three classes of buyers: Eligible, Not Eligible, and Partially Eligible. This classification will determine whether a transaction is covered under PayPal’s seller protection policy.”

Dawes also notes that PayPal doesn’t cover items picked up locally or in person, or intangibles, such as digital goods or services. If you run a business that sells information products or any kind of service, PayPal seller protection won’t do much for you.

However, seller protection affords many e-commerce businesses a certain peace of mind as long as they meet the requirements for the program, which Dawes spells out in layman’s terms:

- The buyer’s order must have a physical good that can be shipped.

- Buyers’ accounts must be verified, and orders must be shipped to the address entered on the account.

- If a dispute is filed, the seller must submit the requested documentation ASAP to prove the order was shipped to the correct address.

- The seller’s address must be in the United States.

Learn more about PayPal seller protection.

Now it’s time for the fun stuff — PayPal’s tech offerings. We cover their apps and integrations in the next chapter.

PayPal software, apps, and integrations

The PayPal software ecosystem is vast and includes all manner of solutions for consumers and businesses alike. Relying on White’s technical expertise, we focus on the most relevant apps and integrations you need to know about.

PayPal mobile apps

PayPal app

There is a PayPal app for Android and iOS, which you can find on Google Play and the App Store, respectively. Consumers use the PayPal app to send, receive, and access their money securely and for free. Of course, a PayPal account is required to use the app.

With the PayPal app, you can do the following:

- Use your bank account or PayPal Cash balance to send money to someone using their phone number or email.

- Track and monitor every transaction you make.

- Collect money from a group of people by creating a custom Money Pools page, such as when coworkers chip in for an office gift. You’ll need to set up PayPal Cash or PayPal Cash Plus to create a Money Pools page. Otherwise, people chipping in only need a PayPal account.

- Link PayPal to investment service Acorns and micro-invest your PayPal Cash or PayPal Cash Plus funds. Options include one-time or recurring investments.

- Donate directly to any of the thousands of approved PayPal charities and causes.

PayPal Business app

Like the standard PayPal app, the PayPal Business app is available for both Android and iOS. Its purpose is to help you manage your business transactions.

With the PayPal Business app, you can

- Create and send invoices to customers, track unpaid invoices, and send reminders to help you get paid

- Generate reports on business trends, such as monthly, quarterly, or yearly sales

- Transfer funds between linked accounts, check your account balance, view transaction details, and issue refunds

- Access your PayPal customer information, view their transaction history, and contact them

PayPal Here app

Also available for Android and iOS, the PayPal Here app is mobile point-of-sale software. To be fully functional, the app requires a companion PayPal credit card reader.

With the PayPal Here app and card reader, you can

- Accept payments on your mobile device from debit and credit cards, including major card brands like Visa, Mastercard, American Express, and Discover

- Accept contactless payments like Apple Pay or Google Pay (though the card readers that accept these are more expensive)

- Create a product and service list, including photos and descriptions, for checkout

- Set up employees with special roles and permissions to accept payments on your account

- View sales reports based on variables such as time, products, services, and employees

PayPal web apps and integrations

PayPal Checkout

This integration’s biggest selling point is its focus on reducing shopping cart abandonment rates, which average about 70 percent. A complicated checkout process is one of the main culprits behind this high rate, which is why PayPal Checkout cuts down on the number of actions a customer must take before completing their purchase.

One of the most visible ways it does this is with Smart Payment Buttons, which give customers the option of paying with PayPal, Venmo, or PayPal Credit through a secure popup window. Compare this to a customer having to navigate away from the shopping site to the PayPal website to complete their transaction.

White notes that this integration is important because online retailers are always looking for ways to reduce friction in the checkout process. “Even eliminating a single step can improve conversion rates significantly. This means higher profits.”

While PayPal keeps its checkout solution up to date, you will need some technical help to set it up. According to White, “PayPal recommends that you work with a developer to integrate the solution, and for good reason. When you’re running an e-commerce operation, the last thing you want to do is introduce a new integration or widget without technical knowledge. You could cause some serious digital damage and hurt your bottom line.”

You can integrate PayPal Checkout with a number of popular third-party solutions, such as WooCommerce and JotForm.

PayPal subscriptions

If you’re looking to attract customers to sign up for subscription-based goods or services, PayPal Subscriptions is an option. For example, you may want to enable your customers to purchase an item, such as lipstick or a bag of dog food, automatically every month.

With PayPal Subscriptions, you can

- Create subscription plans that charge customers a fixed amount on a set schedule or based on a subscribed item quantity

- Offer customers free or discounted trials to generate more subscription signups

- Modify the price of your plans as needed

- Enable customers to upgrade and downgrade their subscription plans or adjust their subscribed item quantity

- Automate payment recovery for failed payments

“Subscriptions offer a great way to get recurring revenue from customers, whether you sell physical goods or offer ongoing services. Just remember to get a developer’s help to ensure you set everything up right,” says White.

Speaking of integrations, there are many ways PayPal can be used with other solutions to help your business run a little smoother. Check out one such integration in the next chapter: PayPal + JotForm.

The PayPal + JotForm integration makes accepting payments easy

Do you operate an e-commerce store with physical inventory? Have a digital business that sells information products? Run a hotel and need a way to collect customer details and take payment? Own a gym and want to sign up your customers for a monthly membership plan?

Much like PayPal, JotForm can help your business get customers from the interest stage to the purchase stage — whether you sell goods or services, whether your business is for-profit or nonprofit, and whether you need a simple form or a robust form and payment solution. JotForm is a simple-to-use form builder that lets you seamlessly add a payment form to your website and integrate it with a number of payment processors, including PayPal.

With the JotForm + PayPal integration, you can easily

- Create branded, amazing-looking order forms to improve customer perception and conversion on your digital goods and physical products

- Collect customer information that’s important for delivering your services, and easily accept payment

- Ask for feedback from customers when collecting subscription payments, and then use that feedback to ensure customers stay subscribed

All you need is an account with JotForm and a business account on PayPal.

Your PayPal integration options

Everyone loves choices! See which one of these JotForm-PayPal integrations is best for your business:

- PayPal Payments Standard. Quickly create a simple payment form, then give your customers the ability to pay with their PayPal accounts. After submitting a PayPal-integrated form, including payment details, customers are redirected to a PayPal payment page to complete their transaction.

- PayPal Checkout. Provide your customers with additional payment options on the payment form you created, including PayPal Credit, Venmo, and debit or credit card. Instead of being taken to a new page, customers can simply check out in a popup window that opens after clicking one of PayPal’s checkout buttons.

- PayPal Payments Pro. With this option, customers don’t have to sign into their PayPal accounts to make a payment through your form. (They don’t need an account at all!) Customers can pay you directly using their credit card and, unlike the standard version, remain on your site throughout the transaction.

Regardless of which option you choose, you and your customers can transact safely. JotForm is the only online form software that is PCI DSS Service Provider Level 1 compliant, which is the highest standard in payment security. (That means we’re really secure!)

There are also no additional fees with any of these PayPal integration options. You only pay the fees PayPal normally charges.

And remember: Our forms are fully customizable. Change the logo, add or remove items, or modify the look and feel. JotForm gives you the power to choose exactly how you want to represent your business and move customers along in the purchase process — all with easy-to-use forms.

Ready to get started? Check out these PayPal-integrated templates for inspiration, or start your own from scratch!

More about your PayPal guides

Sean Dawes

Dawes is the cofounder of Modded Euros, a U.S.-based e-commerce retailer that sells aftermarket performance parts for the Audi, BMW, and Volkswagen brands. His business uses three payment processors: PayPal, Stripe, and Affirm.

“While we started out using only one payment method, we’ve grown large enough to bring on additional payment options. We want to make sure our customers have a choice at checkout and maximize conversion,” says Dawes.

John Frigo

Frigo is the digital marketing lead for My Supplement Store, a U.S.-based ecommerce retailer that sells a large variety of supplements and sports nutrition products. However, his PayPal experience comes from operating a niche e-commerce business in the collectibles space for seven years.

“PayPal provided a needed sense of trust when I first started my online store. And while I’ve had my good and bad times with the platform, overall it was quite useful,” he notes.

Peter White

White is the founder of Tenancy Stream, a U.K.-based software-as-a-service platform that helps landlords save time and money, and eliminates hassle with regard to property management. He was a developer for many years and gained technical knowledge of PayPal by helping businesses integrate PayPal and other products.

“I’ve seen PayPal from a perspective most haven’t — the backend. I’ll just say it looks quite different! But that perspective gives me some useful technical insights,” he says.