How to Write a Business Plan

What can a disgruntled student with a notebook achieve? More than you would think.

In the 1960s, a 15-year-old student in the U.K. become frustrated with the “archaic school practices of the day.” Although he was told to write about his frustrations in the school paper, his ideas were deemed too radical to publish. So he decided to start his own publication to unite the voices of students from multiple schools.

With a notebook in hand, he started to research what it would take and wrote out his plan. Some 50 years later he would go on to say, “Thus, with contributors, advertisers, distributors and costs all in place — at least on paper — I had written my first business plan.”

This simple plan led him to found a successful magazine that featured interviews from stars of the day like Mick Jagger. This early success encouraged young Richard Branson to found many other businesses and eventually build a multibillion dollar fortune.

The lesson is that a business plan, even an extremely simple one, can make a bigger difference than you think.

Today, Richard Branson prefers to use back-of-the envelope plans to organize his ideas for any new business. Even so, he strongly advocates that entrepreneurs write down their ideas and provides a business plan template through Virgin Start Up.

Have you put your business ideas on paper? Is your business plan in place? Remember that even a plan in a notebook can achieve far more than you might imagine.

Here is an overview of how to write a business plan in 8 steps:

- Write an executive summary

- Describe your company and how it will operate

- Draft a mission statement

- Identify your market and audience

- Analyze your competitors and identify opportunities

- Differentiate your business from the competition

- Create a roadmap and define KPIs

- Create a financial plan

In this guide, we’ll walk you through everything related to writing a business plan, from the executive summary to the financial plan. Let’s start with why.

Three reasons writing a business plan is critical

“It takes as much energy to wish as it does to plan.”

Eleanor Roosevelt

Starting a new business is exciting. But that initial spark and passion can put you at risk of failure. Early on, it’s easy to get swept up in the excitement of the idea for your business. As a result, you may not think about how to communicate that idea to others in a way that makes them want to support you. It can also be easy to fall victim to unseen risks and poor planning.

Understanding how to write a business plan and using this information to write your first one will help you in three key areas, all of which represent compelling reasons to write a business plan.

Give yourself clarity

The first and most important reason to write a business plan is to give yourself clarity. As you build a business, you’ll face many difficult decisions. For example, you may wonder who you’ll need to hire and what kind of infrastructure you’ll need to support your growth goals.

You’ll also need to figure out the things that have to happen in order for your business to achieve its mission. Knowing how to react in the face of these decisions can feel impossible, especially when the pressure’s on. Creating a business plan will help you prepare for these milestones and stay focused and committed when they come up.

Support your marketing efforts

A business plan will greatly benefit your marketing efforts. Whether you’re marketing to potential customers or trying to get partners on board, it’s critical that you get them excited about your mission, your product or service, and the steps you’ll take to ensure everyone involved gets something of value.

If your audience can’t understand what your business is trying to achieve, how you’ll achieve it, and why that should matter to them, then they’re unlikely to buy from you or partner with you. This will quash any marketing efforts out of the gate.

Get support and backing from stakeholders

A business plan is critical to getting support and backing from stakeholders. This includes investors, banks, and vendors. It also includes any type of organization that will back your business growth. For example, you may need FDA approval for a new food product or type of packaging.

Anyone who plans to back your business will need to be taught about your industry, the risks you face, your competitors, your team, and your overall plan for success. Writing a business plan will allow you to fully research these areas and make convincing arguments as to why others should support you.

Should you skip a business plan? The dangers of the “Me Test”

“Entrepreneurs who write formal plans are 16% more likely to achieve viability than the otherwise identical nonplanning entrepreneurs.”

Many people will recommend that you simply focus on creating a good concept for your business. They may tell you to just run with it, without digging deeper. The idea is that once revenue starts coming in, you’ll know it’s a good idea and you can start the real planning.

This approach has worked for some, but it’s risky and will leave you unprepared for difficult challenges and conversations related to your business.

Writing a business plan, even when you don’t technically need to, will help you clarify your ideas and identify the most likely roadblocks to your business’s success. A business plan will also help you get third-party validation for your ideas and plans.

In entrepreneurship, there’s a fallacy called the “Me Test.” This fallacy occurs after you come up with an idea for a business that you like. You bounce your idea off your best friend from college and your mom, and they both say, “Wow, that’s great!” Then you immediately start building your business at warp factor 9 without ever asking anyone else if it’s a good idea.

A business plan will help you shift from doing a “Me Test” to a “We Test.” As you write your business plan, you’ll be able to validate your ideas through unbiased research on your competitors and potential customers. This helps you confirm that you’re not the only one who likes the idea since you’ll be able to gauge interest and support for it.

As an entrepreneur, having an optimistic attitude is critical. Many of the great entrepreneurs of our time wouldn’t be where they are today if it weren’t for optimism. But you can be sure they tempered that optimism with a realistic plan that took into account everything that could affect their business growth.

If you want your company to achieve a margin of the success that great companies like Apple, Microsoft, and Amazon have achieved, then you need a business plan. You can’t rely on chance or any other random factor to achieve success. You need to plan for it.

How to write an executive summary

The executive summary is one of the most important sections of a business plan. In some cases, it will be the only thing that people read. In others, what people see in the executive summary will keep them reading. No matter who your audience is, they’ll review the executive summary. This makes it the most critical element to get right.

What is a business plan executive summary?

It’s generally the first page of your business plan, and it summarizes the points from each section. This allows readers to quickly familiarize themselves with your entire business plan without having to read every page. Most important, it states what your business is and why it will be successful.

Beyond summarizing these points, an executive summary will also act as an introduction to your business plan. This means it can’t just be informative; it needs to grab attention.

A good introduction is relevant and presents a problem to the audience that your business will solve. You could present this problem through statistics, a story, or some other type of anecdote. Use any kind of tool that helps make the problem real and easy for the reader to understand.

Next, ensure that your introduction provides relevant information that gives valid reasons why your business can solve this problem. The challenge is trying to do this in just a few sentences.

Once you lay this groundwork, you can begin to summarize your business plan. Make sure that the summary ties each successive point back to the problem you brought up in the introduction. Then connect the point to the reader by explaining the “so what” behind each part of your plan.

The executive summary format

The executive summary format you choose will depend on the structure of your business plan. As a result, you’ll usually write this summary last. Use the table of contents as your executive summary outline, and then write a paragraph or two to elaborate on each point from your outline/TOC.

This section can be difficult to write, so it’s good to look at some examples for inspiration. The Balance Small Business provides a concise, compelling executive summary example.

Now that you have a better understanding of the purpose of the executive summary, it’s time to focus on the starting point for your business plan: the company overview.

How to write a company overview

A company overview is a high-level snapshot of your company that lists your company composition, legal structure, and mission statement. As the name implies, the company overview helps your readers quickly understand your organization.

Why should you care about creating a company overview? Because no one wants to invest in a sinking ship. If investors sense disorganization or inexperience from the beginning, they may not be willing to stick around. By determining the details of your business beforehand, you’ll give investors the confidence they need.

But what if you don’t need investors for your company? A company overview will still be beneficial. For example, determining how your business will solve customer problems will help you make important decisions. It gives marketing the needed direction to create effective materials and keeps your team focused on creating products that continue to solve those problems.

The process and structure behind a great company overview

While company overviews differ in both length and composition, they all have a few things in common. The majority of company overviews will at least contain the following:

- Company summary

- Mission statement

- Company history

- Management team

- Legal structure and ownership

- Location

- Products and services

- Target market

- Competitive advantage

- Objectives and goals

We’ll go through each of these one by one, but before getting started, you should consider why you’re creating the company overview. Are you trying to secure investments, or are you simply creating a guiding document for your team?

Knowing the purpose of your company overview will help you tailor it to better serve the reader. Now, let’s jump into what each of these components means.

Terms defined

Company summary. Like writing a summary of a book, this is where you sum up everything about your business. As briefly as possible, tell the reader important details, such as your company name, what your company does, and the problems it will solve.

Mission statement. This tells the reader why your company exists. It’s your chance to explain your vision, purpose, and values. We’ll dig a bit deeper into the mission statement later.

Company history. If you’ve already started your company, tell the reader the history of your company. When did you start it? How did you get started? What milestones have you achieved up to this point?

Management team. Tell the reader who runs the company, their qualifications, and any other relevant details about them.

Legal structure and ownership. How is your company set up? Is it a sole proprietorship, a corporation, an LLC, etc.? Who owns the company?

Location. Talk about where your company operates from and if there are plans to expand to other locations. If you’re planning on expanding, elaborate on why.

Products and services. Give an overview of your products and services. This shouldn’t get too technical, but it should demonstrate the value you’re adding to the marketplace.

Target market. Talk about what your ideal buyer looks like, their demographics, and what problem you’re solving for them.

Competitive advantage. Tell readers why your company will succeed. Are you filling a gap in the market? Do you have access to a technology your competitors don’t?

Objectives and goals. Talk about your short-term and long-term goals. Make sure these goals are measurable and realistic. They should demonstrate that you’re successfully acting on your business plan.

Some of the sections we’ve defined are pretty straightforward, while others require a little more effort. Next, we’ll look at one of these more complex sections and how you can set it up.

Setting up your organizational structure

To be clear, there are multiple structures that you need to set up within any business. This might include how the organization is structured legally, how management and departments are built, and the physical infrastructure of your company.

For example, an e-commerce business with one central location would be structured very differently from a chain restaurant. Each is unique and would benefit from a completely different type of legal, managerial, and physical infrastructure. This means that as you structure your business, there won’t be a one-size-fits-all strategy. Instead, you need to match the structure with the business.

Let’s talk about the three different structures that you need to define.

Legal structure. Your business’s legal structure can affect your day-to-day operations, how you’re taxed, and your legal risk. It will also make it easier or more difficult to bring in investors. The most important thing to think about is how you want your company to grow and change over the next 10 years; choose the structure you ultimately need to achieve that. For a full overview of legal structures and their risks, review to this guide from the SBA.

Managerial structure. It’s important to choose the right managerial structure because this will affect your leadership team, how support teams are set up, and overall company communication. Again, the right way to set up your managerial structure depends on the type of organization you have. For example, a restaurant chain may benefit from a functional structure with traditional layers of hierarchy, whereas a software company might benefit from a flatter matrix structure.

The main types of structures include

- Functional. This is a more traditional structure that’s grouped by activities. For example, your VP of marketing would be responsible for your marketing managers, sales managers, and the staff they oversee. The VP or C-suite leaders all work under the direction and leadership of the CEO.

- Divisional. In larger organizations, divisions are created to further subdivide the functional structure. This makes it easier to oversee and manage departments but may result in more duplicate effort.

- Matrix. This structure is a combination of functional and divisional structures. It enhances accountability and cooperation between department leaders while increasing flexibility. However, this structure is susceptible to confusion and loss of focus since leaders may work in multiple departments that can break the chain of command.

- Team. Using this structure, teams are built around objectives instead of activities, without regard for position or seniority. This leads to faster decision making and response times, and levels of managers are eliminated, which reduces costs. However, these teams can suffer from time management issues and increased time spent in meetings.

- Network. This business structure is very common for small businesses since it relies on a small team backed by a broader group of contractors who provide specialized work. With fewer constraints on your staff, this approach reduces overhead and increases flexibility. However, it suffers from a lack of control because it’s dependent on external organizations.

Physical structure. The type of business you run greatly impacts what an ideal location looks like. For example, for a retail outlet, an area with heavy traffic might be ideal, while for a service company, cost savings might be a bigger consideration. Why should you care? Location can provide your business with critical advantages like visibility, access to a larger network of peers, and cost control.

From coworking spaces to remote workers, the location landscape has changed a lot in the last 20 years. You should look into all available options to find what’s best for your organization. Once your organizational structure is in place, it’s time to consider crafting your mission and vision statement. This will give your organization direction and help your team deliver on your promise to customers.

Your mission, should you choose to accept it

The mission statement is more important than most companies realize and often misunderstood. When written properly, the mission statement helps the entire team understand the main goal of your company. This gives people something to rally around and helps guide them when presented with decisions that seem to conflict with your company’s goals.

Why do we say that the mission statement is often misunderstood? Many organizations use the mission statement in their marketing materials. While it’s not necessarily bad to do this, it can result in a mission statement that’s full of marketing jargon.

To avoid this, work from the inside out. Start by considering the mission statement as an internal document and then use it in marketing when appropriate. How can you get started writing yours?

Writing the mission statement in 5 steps

- Get the right people in the room. The best way to build support for your company’s mission is getting the right people in the room from the start. Ask yourself who will influence the company, who deserves to be in the room, and who will have a pulse on your company’s purpose.

- Start with your purpose. The heart of your mission statement should state why you’re in business. Exercises like Simon Sinek’s Golden Circle and the 5 Whys are great tools for getting to the core of why you do what you do.

- Brevity is your friend. Some feel that they need to hash out every detail in their mission statement. But this is counterproductive. Keeping your mission statement brief means it’s more likely to be read, more likely to be understood, and more likely to be applied.

- Avoid jargon and be specific. The content is just as important as the length of your mission statement. Avoid writing the way you think you should sound, and stick to what needs to be said. When defining your purpose, identify what’s most important to your business and its future. Communicate that as briefly, as specifically, and as plainly as you can. Clarity is inspiring.

- Communicate your mission regularly. Finally, your mission may be amazing, but if it’s not top of mind, it will be forgotten. Find ways to display your mission and integrate it into team meetings. Encourage and empower employees to not just repeat it but to actually put it into practice with every interaction.

These five steps can help you craft a mission statement that’s both compelling and useful for your organization. Southwest Airlines is an example of a company that has a great mission statement and works to apply it in all that they do:

“The mission of Southwest Airlines is dedication to the highest quality of customer service delivered with a sense of warmth, friendliness, individual pride, and company spirit.”

First, it’s clear that Southwest’s mission is to provide the best customer service around. But they take it a step further by specifying which qualities are crucial to achieving their mission.

Their mission statement is also realistic and achievable. Any employee can strive to display these qualities in their interactions. Southwest doesn’t water down their mission with flashy language that doesn’t mean anything.

After putting the finishing touches on your mission statement, it’s time to work on your vision. This takes the form of your business objectives and goals. It’s not enough to have a nebulous vision. You need long-term goals and short-term objectives if you want to make that vision a reality.

Make your vision a reality with business goals and objectives

If you imagine your business plan as a roadmap, your vision is the destination. This makes goals and objectives mile markers that plot your route for getting there. Choosing the right goals isn’t an aspirational task — it’s strategic. Great goals will be SMART: specific, measurable, achievable, relevant, and timely.

Great goals aren’t simply a desired outcome; they explain why it’s important to achieve them and the path for getting there. How can you create these types of goals for your business? Let’s break it down into a few steps.

- Start with long-term goals and objectives. Before you can start plotting the path, you need a destination. Start by setting goals that are aligned with where you want your business to be in five, 10, and 15 years.

- Set short-term goals and objectives that move you along the right path. With the destination in mind, where do you need to be at the end of the year to stay on track? Where do you need to be at the end of the quarter to make that goal a reality?

- Put your goals and objectives through the SMART test. Once you have your preliminary roadmap, determine if it meets all the requirements of being SMART. Be ruthless here. This is your chance to identify unrealistic goals and replace them with more manageable ones. This doesn’t mean you can’t be a tenacious business owner and reach for the stars. But it’s better to set realistic goals and surpass them, than to always fall short.

Setting good goals takes time. Those who put in the time give their team needed clarity, a roadmap, and a competitive advantage. A lot of your goals will be based on your vision for the company, but the best goals are built on data.

Next, we’ll look at how analyzing the market can improve your business plan and help you make better business decisions.

How to do a market analysis

The market analysis section of your business plan is critical to proving the viability of your business. Your business’s viability, in turn, is critical when you’re trying to gain support from investors, employees, or partners. If you can’t get this support, then your business may be doomed before it even starts — so you need to get it right.

Having market research is most important when you’re seeking early investors. These investors most likely won’t be experts in your market or product, even if they have a lot of business knowledge. The market analysis section of your business plan is your opportunity to educate them in a way that will gain their support. The data in this section needs to be comprehensive and truthful, but there’s also an opportunity to inject facts that show why your business is such a good solution.

Doing this research will benefit you as the founder of the business. It will help you understand the current risks in the market, opportunities for growth, and the challenges that your business will face as you try to break into the market. Doing this homework will help you to think more strategically and even help you come up with creative ideas that will help you overcome early obstacles.

What sections should you include in your market analysis?

There’s a lot of information that you could include, but not all of it will be applicable to every type of business. Let’s start by looking at the information that’s considered absolutely essential:

- Industry description and outlook: a general overview of the industry’s history, current state, and what the future might hold for it

- Target market and total addressable market (TAM): a description of the group of people or businesses you plan to sell to and the number of people or businesses who fit that description

- Competition: a list of competitors that you compare your business against in order to show strengths or weaknesses

- Barriers to entry: a list of the things that make starting the business difficult — for example, high levels of competition or the cost of tooling a manufacturing line

- Pricing: an explanation of how your product or service will be priced and the potential profit

In addition to these critical sections, there are others you can include. Whether or not you include them depends on your business, your industry, and the stage your business is at (for example, a seed-stage startup can get by with a much leaner market analysis than a late-stage startup raising series B funding). Some of these optional sections include

- Market test: a review of any in-market testing that’s been completed — for example, user testing or a beta test

- Lead time: an explanation of how long it takes things to happen, such as how long it takes a custom order to be manufactured and shipped to the customer

- Regulations: a list of federal, state, or third-party regulations that the business must comply with

- Demographics and segmentation: a detailed review of the demographics of the target market, as well as segmented views of the target market

The sections that you include in your market analysis will depend on its purpose. Is your goal to lay out your idea clearly to gain support? Are you creating this plan for your own benefit? Will this plan be going to the desks of high-profile investors or partners? If the plan is only for your own benefit, then running a large-scale market test will likely be too expensive and time-consuming.

In general, the more thorough you can be in your market analysis, the better. This information can be extremely useful for sales, marketing, and product design later down the road.

Market analysis templates and examples

A template is a great place to start your market analysis. Let’s look at two options you can use to kick-start your analysis.

The first one is the lean option that comes from GrowthLab. This market analysis template will help you with the sales and marketing side of your business, and it’s easy to do. In fact, it contains only five questions:

- Who am I going to reach?

- Where am I going to find them?

- What problems are they facing?

- What solutions can I offer them?

- What product can I create?

Answering these questions will be extremely valuable to you early on in your business. More often than not, the companies that succeed are customer centric. These questions help you to be customer centric out of the gate.

There’s one caveat, though. These questions will only give you the customer’s viewpoint of the market. There are things these questions don’t take into consideration, like supply and demand, competitive landscape, barriers to entry, etc. Fairly soon after this “foundational” market analysis, you may need to run a second, more complete analysis.

What would this analysis look like?

SCORE provides a very thorough business plan template that includes several pages of market analysis tools (you can find a similar fillable strategic plan template here). This template includes instructions and worksheets for

- SWOT (strengths, weaknesses, opportunities, threats) analysis

- Competitive analysis

- Marketing expenses strategy chart

- Pricing strategy

- Distribution channel assessment

These worksheets are focused, detailed, and extremely granular. They’ll force you to answer difficult questions about your business — the ones that will make you question your plans and feel a little uncomfortable. It’s easier to answer these questions during planning than it is when an investor springs one of them on you.

Tools and resources to support your market analysis

As you run your market analysis, you’ll be asking a lot of questions you won’t know the answers to offhand. You’ll need reliable data to base your answers on. More important, this data needs to be seen as reliable by whoever you’re presenting your business plan to.

The Small Business Administration offers a categorized list of resources to answer some of the most important questions in your market analysis. It’s mainly made up of government organizations that maintain specialized databases of information.

In addition to these resources, find resources specific to the niche you’re pursuing. For example, if you’re offering a software solution to enterprise-level companies, you may want to include research from a top consulting firm like Gartner. These specialized firms will research areas of business that government organizations don’t cover.

Once you’ve looked at the data, take your research a step further by learning about your target market and customers. To perform this customer research, follow these steps:

- Identify who you’re going to research (this definition could be CEOs at Fortune 500s or stay-at-home dads who love Star Wars).

- Determine what you need to know about this type of customer so you can build your company around them.

- Create a set of questions that will help you get the information you need (if possible, turn them into an online form using this market research survey template).

- Share the form with your customers, or potential customers, and ask them to fill it out.

- Take it a step further and interview a few people to gain qualitative insights.

- Review your data and turn it into buyer personas or a target audience definition.

Following a customer research process like the one described above is essential to writing a compelling business plan. And this type of research should be a foundational part of your business, whether you’re writing a plan or not.

Some of the most effective business plans take customer research a step further. In addition to learning about customers, some companies will test their product or service on them. For example, a business that centers on an app may have customers test a prototype of the app. Or a product-based business may run tests on their product samples with real consumers.

Product testing will add a touch of professionalism to your business plan and increase the confidence of anyone considering investing in your business. Test results are also excellent sales and marketing tools since they allow you to let the results speak for themselves.

When you take the time to go the extra mile in your market analysis, it will show anyone who reads your plan just how serious you are about your business. And that’s a good thing.

How to do a competitive analysis

Military strategist Sun Tzu said, “If you know the enemy and know yourself, you need not fear the result of a hundred battles.” The same holds true in business. When you understand your competitors’ businesses, it’s easier to find your unique value proposition and communicate that value proposition in sales and marketing.

Within your business plan, the competitive analysis section plays multiple roles:

- It informs readers of the competitive landscape.

- It shows gaps and opportunities in the market.

- It highlights differentiators and your own unique value proposition.

- It guides every part of your business strategy.

Most important, successful companies continually analyze their competition. Even Apple and Microsoft do it (as evidenced by their dueling ad campaigns).

Let’s look at how to run an effective competitive analysis when preparing your business plan.

Identifying your competitors and building a summary

The first step is creating a list of competitors. One of two things can happen at this point: Either you’ll immediately come up with a list of all of your competitors, or you’ll say, “We’re different; we don’t really have competitors.” No matter what category you fall into, it’s still important to take your time on this step.

Even if a list of competitors springs to mind, you’ll always miss something, and you don’t want it to surprise you further down the road. If you say you don’t have competitors, then you’re wrong. It’s likely that your competitors are indirect or that your competition is the status quo. So don’t skimp on the competitor list.

Your competitor list needs to account for three basic types of competitors:

- Direct competitors. These are other businesses or organizations that provide the same product or service you provide. This list will include the names of businesses your customers used to buy from before switching to your business, as well as the names of the businesses that are taking your customers.

- Indirect competitors. These are companies or tools that can indirectly solve the problem your business solves for its customers. For example, an indirect competitor for coworking spaces could be coffee shops (they don’t sell the same thing, but a remote worker could work from either one).

- Aspirational competitors. These are businesses or organizations that are too big or well-established to be considered direct competitors. But aspiring to compete with them can drive your business to provide a higher level of service, which translates into growth.

Try to list as many competitors as you can in each category. Really push yourself to think of as many angles as possible. When you’re done brainstorming, you can trim the list to the most important competitors.

Creating a competitive landscape analysis

With a final list of competitors in hand, you can start to reconstruct the landscape for your business plan’s readers. This can take a few forms, depending on the type of business plan you’re creating and its purpose.

Let’s start with a traditional business plan that’s designed to garner support from its readers. What are the essential elements you need to include? The SCORE business plan template that we referenced earlier uses a table to present the competitive landscape. You can use this table to compare yourself against your top competitors across 15 points. Some of the most important points are

- Products

- Price

- Quality

- Service

- Reliability

- Company reputation

- Sales method

- Advertising

In addition to points like these, you should also add points that are relevant to your business and industry. For example, if you sell a software product, you may want to compare your UX against your competitors. Or if you’re a manufacturer, you may want to compare the processes and technologies you use in manufacturing. The key is including the things that will matter most to your stakeholders.

Differentiating your business from the competition

Once you’ve identified your competitors and laid out the competitive analysis, it’s time to use that information to differentiate your business. GV (formerly Google Ventures) has developed one of the single most effective methods for doing this. It’s called a brand sprint.

Why should you use brand sprint exercises as part of your competitive analysis? There are two main reasons. First, a brand sprint allows you to visually display the competitive landscape. Second, it will help you identify ways to further differentiate your business.

There are six components to a brand sprint:

- 20-year roadmap

- What, how, why

- Top three values

- Top three audiences

- Personality sliders

- Competitive landscape

All of these components are useful in differentiating your business. But, for now, we’ll focus on the two exercises that matter most for the competitive product analysis section of your business plan.

The first exercise is “what, how, why” and is based on Simon Sinek’s Golden Circle. You just answer three questions: What do you do? How do you do it? Why do you do it? The answer to the first question won’t include any earth-shattering information; what you do should be clear throughout your entire business plan. But your answers to the next two questions give you an excellent opportunity to differentiate your business and create emotional appeal.

For example, your answer to the “how” question gives you a chance to show how your process, product, methodology, or approach is different. You may just be another coffee shop, but the fact that you roast your beans in-house and use a unique brewing method may be the differentiator that catches an investor’s eye, especially if no one else in your market is using that approach.

Your answer to the “why” question gives you a chance to appeal to emotions. It tells the story of what’s driving you to get into this business and succeed. Investors have become increasingly interested in what drives company founders to go into business since this can be an indicator of their commitment and follow-through. Your why doesn’t have to be complicated, it just has to be truthful. For example, a coffee shop’s “why” could be to give patrons a unique and refreshing coffee drinking experience.

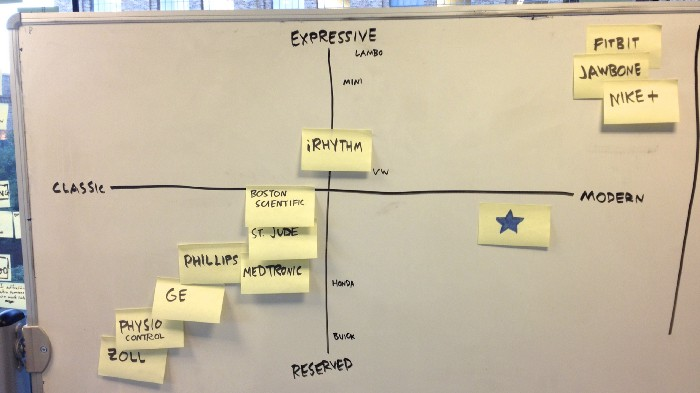

The second exercise that can add impact to your business plan is a competitive landscape analysis. This exercise consists of creating a 2×2 matrix with a horizontal line going from classic to modern and a vertical line going from expressive to reserved. It’s best to do this exercise on a whiteboard with lots of sticky notes.

With your tools assembled, it’s now time to organize yourself and your competitors on the 2×2 matrix. Here’s an example of what that looks like from GV:

The purpose of placing yourself in relation to your competitors on this board is to show where your company lives in the competitive landscape. Ideally, the group that’s reviewing your business plan will have some knowledge of your competitors, which will allow them to act as anchor points. Seeing your business in this type of matrix will allow them to instantly understand where your product belongs in the landscape.

With an effective competitive analysis in place, it’s now time to get down to brass tacks. Let’s look at what it takes to create your business’s financial plan.

Creating your business’s financial plan

“Long term thinking and planning enhances short term decision making. Make sure you have a plan of your life in your hand, and that includes the financial plan and your mission.”

—Manoj Arora, From the Rat Race to Financial Freedom

Your business’s financial plan has one of the most important jobs — proving that your business concept is viable. Your motivation for starting a business may be freedom, getting rich, or not answering to the man. But all businesses have something in common: They need to make money.

If you want to secure outside investments, you need to include a financial plan as part of your business plan. This document gives investors incentive to invest in your business by giving them a clear picture of financial forecasts and risk. So what’s included in the financial plan?

- Sales forecast. This a projection of your sales revenue over the next three to five years. It’s typically based on sales data, market analysis, and sales estimates.

- Expense budget. The expense budget will lay out all expenses required to start your business and operate it. If your business is just getting started, you’ll have to create estimates for most of the expenses. Also, if you’re already in business, you might replace startup costs with expansion costs.

- Cash flow statement. The cash flow statement shows how cash flows in and out of your business during a specific time period. It breaks down the analysis into three main categories: operating, investing, and financing.

- Profit and loss statement. A profit and loss statement summarizes your total income and expenses for a period of time — typically a quarter or a year. This statement helps business owners visualize adjustments they can make to both sales and expenses to become more profitable, and shows how sales and expenses affect each other.

- Balance sheets. A balance sheet shows a snapshot of the company’s current assets, liabilities, and shareholders’ equity. Since the balance sheet only shows your current situation, it’s best used in comparison with older balance sheets to get a fuller picture.

- Break-even analysis. The break-even analysis tells you at which point you’ll break even. This report analyzes price points and market demand to determine the amount of sales necessary to cover the cost of running your business.

The different reports in your financial plan allow you to get a complete picture of your business’s viability both in the short and long term. They are crucial to planning your business’s future and securing investments. To continue assembling your plan, we’ll go over the most basic elements of the financial plan: the income statement, cash flow projection, and balance sheet.

Income statement

If you compared your business to a car, your income statement would measure engine efficiency. This is because sales and income fuel your business. The income statement helps you get a pulse on how profitable your business is and which departments are stars and duds.

Your income statement’s goal is to help you calculate your net income. The equation is net income = (revenue + gains) – (expenses + losses). As you can see, there are five net components to the income statement.

- Revenue. The first step to putting together your income statement is calculating how much your company makes in revenue, both in ways directly and indirectly related to your core services.

- Gains. Next, you need to calculate the income you make from other sales. This can include the sale of property, such as vehicles, buildings, and other equipment.

- Expenses. Now you’ll want to calculate the money leaving your business. This includes all costs the business takes on in order to make revenue. Collecting all the expense data can be a challenge, but one thing that can make this easier is leveraging digital forms for your expense reports.

- Losses. Add up the losses. These are called losses because, unlike expenses, they don’t help the company generate revenue. An example is having to refund an unhappy customer for services that have already been performed.

- Net income. Once you have your numbers from steps one through four, you can use the equation we mentioned earlier: (revenue + gains) – (expenses + losses) = net income.

The business plan income statement is especially useful for determining the profitability of your business. But you can also use it to see how your business is performing compared to similar businesses in your industry. The income statement can empower your leadership team to make decisions and change course when things are off track.

Balance sheet

Are you looking for quick insights into your business’s financial health? If so, the balance sheet will be your new best friend. The balance sheet is a snapshot of your financial situation for a specific period of time. When compared with balance sheets from the past, you can piece together a broader picture of how your company is performing and even identify trends and seasonal shifts.

How can you create a balance sheet for your financial plan? The basic equation for your balance sheet is assets = liabilities + owner’s equity. The reverse (owner’s equity = assets – liabilities) gives you the same output. You can create your balance sheet by gathering all of the financial data you need and organizing it properly.

Assets are a breakdown of what your business currently owns, including cash on hand and what your customers currently owe you. Assets include

- Cash

- Accounts receivable

- Inventory

- Prepaid expenses

- Securities

- Notes receivable

- Fixed assets

- Other assets

Once you have the totals for each of the categories, add them up to get the amount for your total assets.

Liabilities are the debts your company owes, both current and long term. For simplicity, long-term liabilities are debts that have a payback period longer than a year. Current liabilities are any debts that need to be paid back within the year, like payroll. Add up all current and long-term liabilities for your total liability number.

Owner’s equity is the amount that would be left for the owners if all assets were sold and all liabilities were paid. To calculate the owner’s equity, you need to add retained earnings (ending balance from previous balance + net income – payout to investors) and contributed capital.

Once you have your three totals for assets, liabilities, and owner’s equity, you can plug them into the balance sheet equations to make sure the totals balance. If they do, congratulations! You’ve successfully created your balance sheet.

Cash flow statement

This is a financial statement that shows how changes in the balance sheet affect revenue. At a basic level, it shows how cash flows in and out of the business. How does it help a business?

The cash flow statement is important to accounting, lenders, investors, potential employees, and company directors because it tells them whether the business can cover important expenses like payroll, operating expenses, and debts. With the cash flow statement, those thinking of investing in the business will be able to quickly spot a risky investment.

You can create a cash flow statement in two ways. The first, and more complex, is called the direct method. The second, simpler version is called the indirect method and is the preferred method for most business owners for that reason. To put together your cash flow statement, you’ll need to gather financial data for operating activities, investing activities, and financing activities. The Balance Small Business has a great article on using the indirect method.

All of the financial statements we’ve covered can give you useful insights for business planning and attracting investments. But by covering the big three — the income statement, balance sheet, and cash flow statement — you’ll have what you need for a compelling business plan.

Making the most of your business plan

A business plan can do a lot of things. It can help you gain the support of stakeholders, clarify your ideas, and overcome roadblocks. Most important, business plans are the foundation of some of the most successful and revolutionary businesses today.

There is one danger with business plans though.

It’s easy to create your business plan and then file it away to gather dust. A few short months later, you could have deviated so far from the plan that your business looks nothing like you expected it to. Or worse yet, you may have made little to no progress at all.

How can you ensure that you make the most of your business plan?

- Share it with anyone who will be important to your business — whether an investor, your bank, a mentor, a partner, or your first employees. The more you share and explain the business plan, the more valuable it will be.

- Make frequent updates to your business plan. It needs to be a living and breathing document that keeps pace with the changes in your business.

- Hold regular meetings to reflect on your business plan and review the progress you’ve made. Systems like EOS allow you to effectively make the goals from your business plan a part of how you do business on a weekly basis.

Your business plan isn’t an academic exercise. It’s an opportunity to build the right launchpad for your business and the dreams you have for it.